Article Highlights:

- Estate and Gift Tax

- Personal Exemptions

- Standard Deductions

- Home Mortgage Interest Deduction

- Limitation on Tax Deductions (SALT)

- Suspension of Tier 2 Miscellaneous Itemized Deductions

- Suspension of the Limitation on Itemized Deductions

- Individual Tax Rates

- Child Tax Credit

- Special Rule for Certain Discharges of Student Loans

- Employer Payments of Student Loans

- Moving Expenses

- Bicycle Commuting

- Discharge of Indebtedness on Principal Residence

- Premium Assistance Credit

- Casualty Losses

- Achieving a Better Life Experience (ABLE) Accounts

- Paid Family and Medical Leave Credit

- New Markets Credit

- Work Opportunity Credit

- Bonus Depreciation

- Employer De Minimis Meals and Related Eating Facilities

Back in late 2017 Congress passed the Tax Cuts & Jobs Act of 2017 (TCJA) that made enormous changes to income tax laws as outlined below. However, most of the provisions of TCJA were only temporary changes that will expire after 2025. During the Covid pandemic Congress made other tax law changes that will also soon expire. So far Congress has not addressed these expiring tax provisions. Will they extend them, let them just expire and return to old law, or address them individually with new legislation?With the potential for significant tax changes on the horizon, taxpayers should begin thinking more urgently about their estate and income tax planning.

What Congress might do is up in the air, especially with 2024 being an election year. It is expected these expiring issues will not be addressed until after the elections. However, to give taxpayers a heads up to the TCJA and other legislation provisions expiring after 2025 the following list has been compiled of the more significant expiring provisions compared to pre-TCJA tax law.

Estate and Gift Tax

Probably the most significant of expiring provisions is the exemption from estate and gift tax, which was about doubled under TCJA and is $13.61 million for 2024. Under pre-TCJA law the exemption would have been approximately $5.49 million adjusted for inflation in 2024. How Congress deals with the exemption amount will mean significant estate planning issues for the more well to do.

Personal Exemptions

Prior to TCJA, taxpayers were allowed an exemption deduction for everyone included in the family. The exemption amount adjusted for inflation is $5,050 for 2024. As an example, if a married couple filing jointly had 2 children dependents and the exemption deduction was allowed for 2024, they would have an income deduction of $20,200 (4 x $5,050). However, TCJA suspended the exemption deduction through 2025.

Standard Deduction

Under TCJA the deduction for taxpayers not itemizing their deductions, termed the standard deduction, was approximately doubled from the pre-TCJA amounts. As an example, the 2024 standard deduction for a married couple filing jointly is $29,200. Under pre-TCJA law it would have been approximately $14,950 adjusted for inflation. The higher standard deduction under TCJA has allowed more taxpayers to skip having to itemize their deductions.

Home Mortgage Interest Deduction

TCJA limited the itemized deduction for home mortgage interest on a taxpayer’s principal and second homes to the interest on a combined acquisition debt of $750,000 ($375,000 for married individuals filing separately) and eliminated the deduction for interest on $100,000 of equity debt. Since that time, homes have soared in value, and correspondingly the amount of mortgage loans, and interest rates have increased significantly. Pre-TCJA law allowed an interest deduction on up to $1 million of home acquisition debt and $100,000 of equity debt. The real estate market will feel the effects of how the deduction for home mortgage interest is treated after 2025.

Limitation on Tax Deductions (SALT)

SALT is the acronym for state and local taxes. Pre-TCJA taxpayers who itemized their deductions were allowed an unlimited deduction on their federal return for property taxes and state and local income tax. TCJA imposed a $10,000 limit on that deduction, which generally impacted higher income taxpayers and those who reside in states with high state income taxes such as CA, NJ, and NY. Many states developed workarounds.

Suspension of Tier 2 Miscellaneous Itemized Deductions

Tier 2 miscellaneous itemized deductions are those which are deductible to the extent they exceed 2% of a taxpayer’s income (AGI). TCJA prohibited these expenses from being deducted. They include legal expenses, which, when not deductible, can be a substantial hardship for someone who wins a taxable lawsuit and then must pay taxes on the entire award or settlement without being able to deduct the amount paid for legal services, which in many cases are 40% of the award or settlement. Tier 2 miscellaneous deductions also include employee business expenses, and not being able to deduct these costs can also be a hardship for employees who must supply their tools, uniforms, supplies or have unreimbursed work-required vehicle or other transportation expenses. Also included are investment fees, job-search expenses, home office for employees, and other work-related expenses.

Suspension of the Limitation on Itemized Deductions

Pre-TCJA itemized deductions were subject to a phaseout that generally affected higher income taxpayers. That provisionlimited itemized deductions to the lesser of 3% of income (AGI) or 80% of those otherwise allowable deductions for the year.

Individual Tax Rates

TCJA not only reduced the top tax bracket for individuals from 39.6% to 37% (this generally only impacts higher income taxpayers), but also reduced the tax rates at almost every level, and adjusted the bracket thresholds.

Child Tax Credit

The child tax credit was $1,000 pre-TCJA. TCJA temporarily increased it to $2,000 through 2025. What Congress decides to do about the credit can have a substantial impact on families with children under the age of 17, especially lower income families.

Special Rule for Certain Discharges of Student Loans

Although not a part of the TCJA changes, current tax law enacted in 2021 excludes cancellation of debt income to any loan provided expressly for post-secondary educational expenses, regardless of whether provided through the educational institution or directly to the borrower, if such loan was made, insured, or guaranteed by the U.S., DC, state, eligible education institution, etc. This provision is available only through 2025.

Employer Payments of Student Loans

A temporary provision included in 2020 Covid pandemic relief legislation permits employers, via their employer-provided educational assistance programs, to make tax excludable payments up to $5,250 towards an employee’s student loan debt. This, too, expires after 2025.

Moving Expenses

TCJA suspended (except for military) both the deduction for a job-related move and the income exclusion for reimbursements.

Bicycle Commuting – Although not a big tax issue, TCJA did suspend the exclusion of the per month $20 inflation adjusted employee fringe benefit for bicycle commuting to work.

Discharge of Indebtedness on Principal Residence

When TCJA was passed the housing market was in decline and homes were being foreclosed upon or voluntarily being surrendered to the lender. In many cases the lender was forced to sell the home for less than the mortgage and generally did not pursue the homeowner for the difference. This resulted in debt relief income for the homeowner, which for tax purposes is taxable income. TCJA included a provision thatexcluded up to $750,000 ($375,000 for married individuals filing separately)ofdebt relief income from the discharge of indebtedness on a principal residence. Because of the current strong housing market, losing this provision after 2025 should affect a very few taxpayers.

Premium Assistance Credit

Premium assistance credit is a credit for individuals who obtain their medical insurance from a government marketplace. Legislation during the Covid epidemic provided certain premium assistance enhancements that have benefitted nearly all those who purchase their health insurance through the marketplace. These enhancements extend through 2025. If Congress doesn’t extend the enhancements, it will mean higher out-of-pocket costs for insurance coverage for a significant number of people.

Casualty Losses

Although TCJA retained the itemized deduction for casualty and theft losses incurred in a federally declared disaster, it did suspend other casualty losses incurred during 2018 through 2025.

Achieving a Better Life Experience (ABLE) Accounts

Federal law enacted in2014authorized states to establish qualified ABLE programs which provide the means for individuals and families to contribute and save for the purpose of supporting individuals, blind or severely disabled before turning age 26 (46 beginning for years after 2025), in maintaining their health, independence, and quality of life. However, several enhancements to the program will expire after 2025. They include the qualifying contributions for the saver’s credit, accepting rollovers from qualified tuition (Sec 529) plans, and an increase in contribution limits.

Paid Family and Medical Leave Credit

Provides a credit to an employer forwages paid to employees while they are on paid family or medical leave. Originated by TCJA for 2018 and 2019, the credit was subsequently extended by Congress through 2025.

New Markets Credit

Not part of TCJA but nevertheless sunsetting after 2025, this provision provides a tax credit for making certain investments in qualified entities resulting in the creation of jobs and material improvement in the lives of residents of low-income communities. Subject to credit carryovers through 2030. This credit generally benefits big business.

Work Opportunity Credit

Not part of TCJA but nevertheless sunsetting after 2025, employers may qualify for a credit for hiring workers from one of several targeted groups. The credit is generally 40% of first-year wages, up to $6,000, which provides a maximum credit of $2,400 per employee.

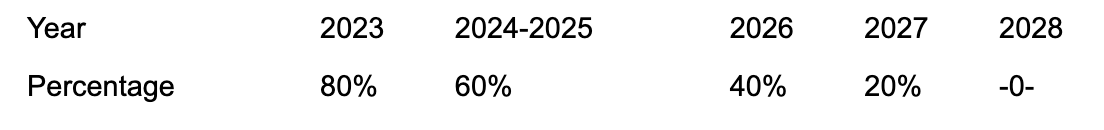

Bonus Depreciation

Bonus Depreciation allows businesses to expense in the year of purchase the cost of business assets (e.g., equipment) rather than spreading the cost over their useful life (depreciating the cost). Bonus depreciation was originally allowed on 100% of the cost of a qualified business asset but has entered a phase where a smaller percentage applies to purchases in succeeding years until bonus depreciation is totally phased out.

Employer De Minimis Meals and Related Eating Facilities

TCJA ended the employer deduction for employer de minimis meals and related eating facility, and meals for the convenience of the employer.

Although it is unknown at this time how Congress will deal with these expiring tax issues, if you have any questions, please give this office a call.