Article Highlights:

- Qualified Transportation Fringe Benefits (QTFB)

- Group Term Life Insurance (GTLI)

- Accident and Health Benefits

- Flexible Spending Arrangement

- Exclusion for Qualified Employee Discounts

- Dependent Care Assistance Program (DCAP)

- Adoption Assistance

- Qualified Educational Assistance

- Working Condition Educational Assistance

- Travel Expenses

- Transportation Expenses

- Moving Expenses

- Reimbursements for Use of Employee-Owned Vehicles

- Employer-Provided Vehicles

- Awards and Prizes

- Professional Licenses and Dues

The tax code allows employers to provide their employees with a variety of tax-free fringe benefits. Not all employers will offer all, or even some, of the possible fringe benefits. But you should check with your employer to see what, if any, fringe benefits might be available and which ones you might benefit from.

A fringe benefit is a form of pay (including property, services, cash, or cash equivalent) in addition to stated pay for the performance of services. Under Internal Revenue Code (IRC) Section 61, all income is taxable unless an exclusion applies. Some forms of additional compensation are specifically designated as “fringe benefits” in the IRC; others, such as moving expenses or awards, are addressed by statutory provisions providing for special tax treatment but are not designated as fringe benefits by the IRC. This article uses the term “fringe benefit” broadly to refer to all remuneration other than stated pay for which special tax treatment is available. Fringe benefits for employees are taxable wages unless specifically excluded by the tax code.

Employer contributions to retirement plans are certainly one of the most significant benefits employees may receive, but this is a separate topic and is not discussed in this article.

The tax rules related to tax excludable fringe benefits and reimbursements are often complex. This article only provides an overview. Please contact this office for further details.

Qualified Transportation Fringe Benefits (QTFB)

These benefits include the cost of:

- Commuter transportation in a commuter highway vehicle

- Transit passes

- Qualified parking

Employers may provide an employee with any one or more of these benefits at the same time. To the extent the fair market value (FMV) of these benefits does not exceed monthly excludable limits, adjusted annually for inflation, the benefits are excluded from the employee’s income, i.e. they are tax free for the employee. The 2024 tax free QTFBs are limited to $315 per month (combined for the commuter highway vehicle and transit passes exclusions). The monthly limit was $300 in 2023). Any reimbursement more than the monthly limit would be included as taxable income by the employer.

Group Term Life Insurance (GTLI)

The cost of the first $50,000 of GTLI coverage provided by an employer is excluded from an employee’s taxable income. Generally, life insurance isn’t group-term life insurance unless it is provided, at some time during the calendar year, to at least 10 full-time employees.

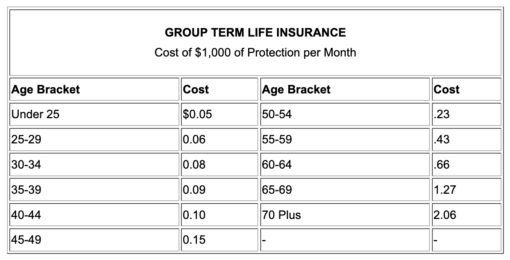

The cost of employer-paid group term coverage of more than $50,000 is treated as taxable income and added to the employee’s W-2, with the cost, and taxable amount being based on the IRS table illustrated below. This amount may be higher than the employer is paying for the insurance, which creates phantom income.

For older employees, the after-tax cost of the additional coverage frequently exceeds the cost for an individual term policy. It may be appropriate for certain employees to only utilize the first $50,000 in coverage and acquire an individual policy for any additional needed coverage.

Accident and Health Benefits

This income exclusion applies to contributions an employer makes to an accident or health plan for an employee, including the following:

- Contributions to the cost of accident or health insurance including qualified long-term care insurance.

- Contributions to a separate trust or fund that directly or through insurance provides accident or health benefits.

- Contributions to Archer MSAs or health savings accounts (HSAs).

This exclusion also applies to payments the employer directly or indirectly makes to an employee under an accident or health plan for employees that are either of the following.- Payments or reimbursements of medical expenses.

- Payments for specific permanent injuries (such as the loss of the use of an arm or leg). The payments must be figured without regard to the period the employee is absent from work.

An accident or health plan is an arrangement that provides benefits for employees, their spouses, their dependents, and their children (under age 27 at the end of the tax year) in the event of personal injury or sickness. The plan may be insured or noninsured and doesn’t need to be in writing.

An employee for this exclusion can be a current common-law employee, a full-time life insurance agent who is a current statutory employee, a retired employee, a former employee the employer maintains coverage for based on the employment relationship, a widow or widower of an individual who died while an employee, or a widow or widower of a retired employee.

Flexible Spending Arrangement

Under a written employer plan (sometimes termed a cafeteria plan), the employee may choose to reduce salary and contribute to an account for medical expenses on a pre-tax basis. Maximum contribution for 2024 is $3,200. Amounts in the account may be used to pay for qualifying medical expenses, generally copays, medication and other out of pocket medical expenses. The contributed amount must generally be used in the year of the contribution or the employee forfeits any balance.

However, in recent years there has been a grace period of 2½ months after the end of the plan year to spend an inflation-adjusted carryover amount which is $640 for 2024.

Exclusion for Qualified Employee Discounts

This exclusion applies to a price reduction an employer gives to an employee on property or services the employer offers to customers in the ordinary course of the line of business in which the employee performs substantial services. It applies whether the property or service is provided at no charge (in which case only part of the discount may be excludable as a qualified employee discount) or at a reduced price. It also applies if the benefit is provided through a partial or total cash rebate.

However, there is a limit on the amount of the discount that can be provided to an employee. An employer can generally exclude the value of an employee discount from the employee’s wages, up to the following limits:

- For a discount on services, 20% of the price the employer charges nonemployee customers for the service.

- For a discount on merchandise or other property, the employer’s gross profit percentage times the price the employer charges nonemployee customers for the property.

For the exclusion to apply, the employee must provide substantial services in the line of business of the employer in which the employer offers the property or services in question to non-employee customers. The exclusion does not apply to highly compensated employees if the qualified employee discounts are available on a discriminatory basis.

Dependent Care Assistance Program (DCAP)

This exclusion applies to household and dependent care services the employer directly or indirectly pays for or provides to an employee under a written dependent care assistance program (DCAP) that covers only the employer’s employees. The services must be for a qualifying person’s care and must be provided to allow the employee to work. These requirements are basically the same as the tests the employee would have to meet to claim the dependent care credit if the employee paid for the services.

For this exclusion, the following individuals are treated as employees:

- A current employee.

- A leased employee who has provided services to the employer on a substantially full-time basis for at least a year if the services are performed under the employer’s primary direction or control.

- The employer if a sole proprietor.

- A partner who performs services for a partnership.

The employer can exclude the value of benefits provided to an employee under a DCAP from the employee’s wages provided it is reasonable to believe that the employee can exclude the benefits from gross income. An employee can generally exclude from gross income up to $5,000 ($2,500 if married filing separately) of benefits received under a DCAP each year. However, the exclusion can’t be more than the smaller of the earned income of either the employee or employee’s spouse.

An employer can’t exclude dependent care assistance from the wages of a highly compensated employee unless the benefits provided under the program don’t favor highly compensated employees. For this exclusion, a highly compensated employee for 2024 is an employee who meets either of the following tests.

- The employee was a 5% owner at any time during the year or the preceding year.

- The employee received more than $155,000 in pay for the preceding year. This test can be ignored if the employee wasn’t also in the top 20% of employees when ranked by pay for the preceding year.

Adoption Assistance

An adoption assistance program is a separate written plan of an employer that meets all the following requirements.

- It benefits employees who qualify under rules set up by the employer that don’t favor highly compensated employees or their dependents. See the dependent care assistance program for a definition of a highly compensated employee.

- It doesn’t pay more than 5% of its payments during the year for shareholders or owners (or their spouses or dependents).

- The employer gives reasonable notice of the plan to eligible employees.

- The employee provides reasonable substantiation that payments or reimbursements are for qualifying expenses.

The employer must exclude all payments or reimbursements the employer makes under an adoption assistance program for an employee’s qualified adoption expenses from the employee’s wages subject to federal income tax withholding. However, the exclusion does not apply to wages subject to social security, Medicare, and FUTA taxes. The maximum exclusion for 2024 is $16,810.

Qualified Educational Assistance

Under an educational assistance plan, an employer may exclude up to $5,250 paid or incurred on behalf of an employer from the wages of each employee if certain requirements are met. The education may be at undergraduate or graduate level and is not required to be job-related.

The following requirements apply for a qualified educational assistance plan:

- The employer must have a written plan.

- The plan may not offer other benefits that can be selected instead of education.

- Assistance does not exceed $5,250 per calendar year for all employers of the employee combined.

- The plan must not discriminate in favor of highly compensated employees (generally, for 2024, those receiving $155,000 or more).

Eligible employees include current and laid off employees, employees retired or on disability, and certain self-employed individuals. Spouses or dependents of employees are not eligible.

Educational expenses include tuition, books, supplies and equipment necessary for class. Educational expenses do not include tools or supplies that the employee may keep after the course is completed, education involving sports, games, hobbies unless job-related, meals, lodging or transportation.

Student Loan Payment

Through 2025, the employer may treat student loan payments – principal, interest or both – as qualified for the $5,250 exclusion.

If the employer doesn’t have an educational assistance plan, or provides an employee with assistance exceeding $5,250, the employer must include the value of the benefits as wages.

Working Condition Educational Assistance

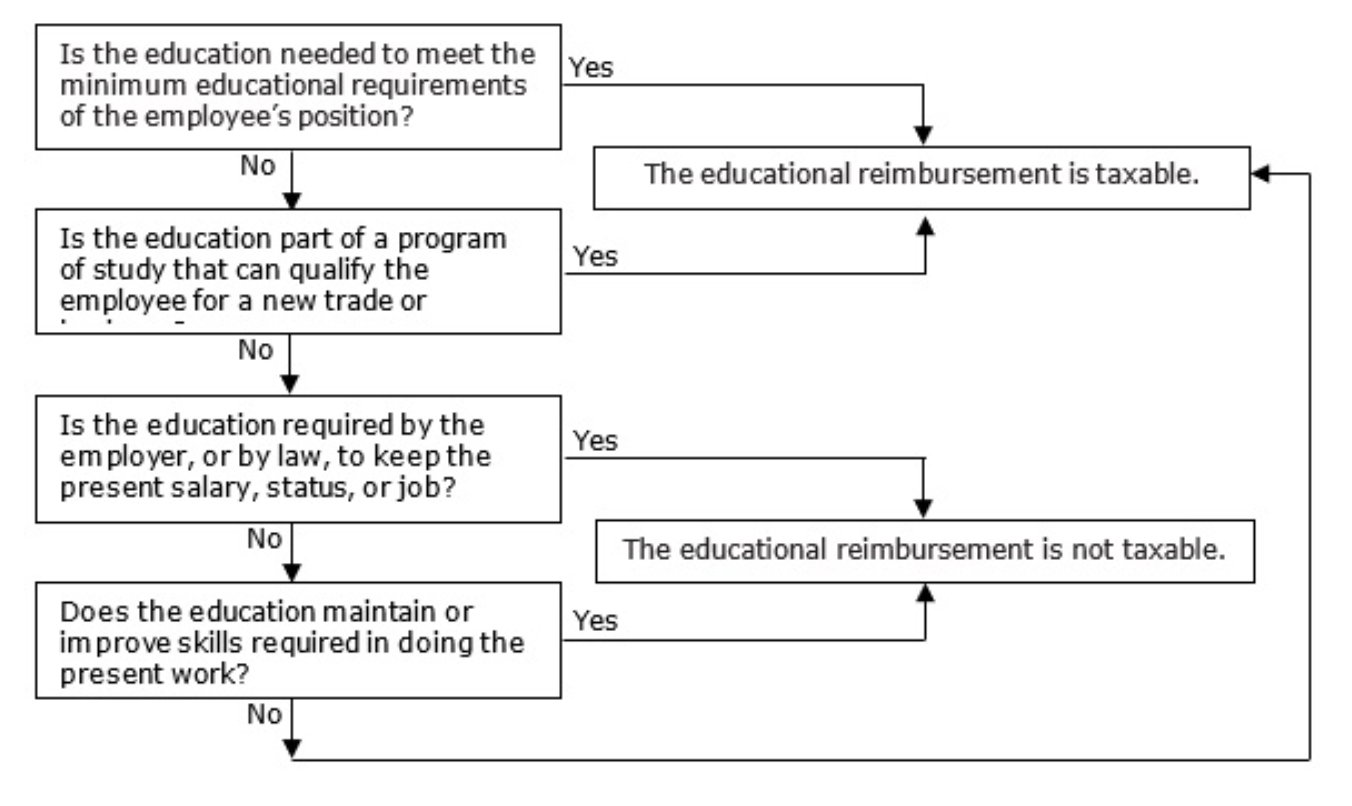

Job-related educational expenses may be excludable from an employee’s income as a working condition fringe benefit, which is an excludable benefit of property or services provided by an employer to an employee so that the employee can perform his or her job (work related). It applies to the extent the cost of the property or services would be allowable as a business expense to the employee if the employee had paid for it. The exclusion is generally available for any form of educational instruction or training that maintains or improves the job-related capabilities of an employee, or meets certain express requirements of the employer, or of applicable law or regulations.

To be excludable, the educational course must not:

- Be needed to meet the minimum educational requirements of the current job, or

- Qualify the employee for a new trade or business.

The following is a general guide to an employee qualifying for Working Condition Educational Assistance:

Qualified expenses generally include the cost of books, equipment, fees, supplies, and tuition. However, these expenses don’t include the cost of a course or other education involving sports, games, or hobbies, unless the education has a reasonable relationship to the employer’s business or is required as part of a degree program.

Education expenses don’t include the cost of tools or supplies (other than textbooks) the employee is allowed to keep at the end of the course. Nor do they include the cost of lodging, meals, or transportation. The employee must be able to provide substantiation to the employer that the educational assistance provided was used for qualifying education expenses.

An educational assistance program is a separate written plan that provides educational assistance only to an employer’s employees. The program qualifies only if all the following tests are met.

- The program benefits employees who qualify under rules set up by the employer that don’t favor highly compensated employees.

- The program doesn’t provide more than 5% of its benefits during the year for shareholders or owners (or their spouses or dependents). For this purpose, a shareholder or owner is someone who owns (on any day of the year) more than 5% of the stock or of the capital or profits interest of the business.

- The program doesn’t allow employees to choose to receive cash or other benefits that must be included in gross income instead of educational assistance.

- The employer gives reasonable notice of the program to eligible employees.

Travel Expenses

Reimbursements received by employees who travel on business outside the area of their tax home may be excludable from wages. Qualifying expenses for travel are excludable if they are incurred for temporary travel on business away from the general area of the employee’s tax home. To be excludable from wages, the travel must be substantially longer than an ordinary day’s work, require an overnight stay or substantial sleep or rest.

Travel expense reimbursements may include:

- Costs to travel to and from the business destination.

- Transportation costs while at the business destination.

- Lodging, meals, and incidental expenses.

- Cleaning, laundry, and other miscellaneous expenses.

Reimbursements for allowable expenses are excludable from wages if the accountable plan rules are met. Meaning the employee must provide the employer with a detailed accounting of the expenses.

Identifying the employee’s tax home is critical because the employee must be considered away from their tax home for reimbursements of travel expenses to be excludable. In most cases, the employee’s tax home is the general vicinity of their principal place of business.

If a per diem allowance is used, the employee is deemed to have substantiated the amount of expenses equal to the lesser of the federal per diem rate or the per diem allowance paid by the employer.

- The per diem allowance must be at or less than federal rates to be fully excludable.

- No receipts are required if a per diem allowance is used, but the payments must meet the other substantiation requirements including date, time, place and business purpose.

- An employer’s substantiation requirements must, at a minimum, meet the federal requirements. An employer may have more stringent requirements, such as requiring meal receipts.

- Generally, the actual documented lodging receipt is required.

Transportation Expenses

Transportation expenses are costs for local business travel that is not away from the tax home area overnight, and that is in the general vicinity of the principal place of business. Transportation expenses do not include commuting costs, which are not deductible business expenses and cannot be excluded from wages if provided by the employer. To be excludable, reimbursements for transportation expenses must meet the accountable plan requirements.

Moving Expenses

The Tax Cuts and Jobs Act suspends the exclusion for qualified moving expense reimbursements from employees’ income for tax years beginning after December 31, 2017, and before January 1, 2026. However, the exclusion is still available in the case of a member of the U.S. Armed Forces on active duty who moves because of a permanent change of station. The exclusion applies only to reimbursement of moving expenses that the member could deduct if they had paid or incurred them without reimbursement.

Reimbursements for Use of Employee-Owned Vehicles

In most situations, when employees use their own vehicles for work-related purposes, an employer can choose to reimburse the employees through a standard mileage rate allowance in lieu of actual automobile expenses and meet the accountable plan rules. A standard mileage rate is considered to cover all expenses of operating a vehicle, including insurance, maintenance, tires, oil and so on. It does not include parking or toll charges.

Mileage-rate reimbursements for allowable business travel are excludable from the wages of the employee under the tax code if equal to or less than the standard federal mileage rate and the employee accounts for the business miles driven.

As of January 1, 2024, the standard mileage rate is 67 cents per mile.

Reimbursements for non-business travel, including commuting, are always taxable even if paid at or below the federal mileage rate and are to be included in regular wages and subject to all income and employment taxes.

Personal commuting between the employee’s residence and the principal place of business is considered non-business travel or personal use.

Reimbursements more than the federal mileage rate are taxable as regular wages to the employee.

Employer-Provided Vehicles

If an employer provides a vehicle that an employee uses exclusively for business purposes and the substantiation requirements are met, there are no tax consequences to the employee and no reporting by the employee is required for that use. The use is treated as a working condition fringe benefit. Business use does not include commuting. Employees should maintain records to substantiate that all vehicle use was for business.

If an employer-provided vehicle is used for both business and personal purposes, substantiated business use is not taxable to the employee. Personal use is taxable to the employee as wages. The employer can choose to include all use as wages; in this case, the employee may reimburse the employer for personal use rather than having it treated as wages.

Awards and Prizes -Unless specifically excluded, prizes or awards given to employees are generally taxable. Cash awards to employees are always taxable. Generally, the value of an award or prize given by an employer is taxable to an employee as wages. If the employer pays the employee’s share of taxes on an award, the amount of taxes paid are additional wages to the employee. There are three types of non-cash awards that may be excluded from income:

- Certain employee achievement awards,

- Certain prizes or awards transferred to charities, and

- De minimis awards and prizes

The maximum amount of excludable awards to a single employee during a calendar year is limited to:

- $400 for awards made under a nonqualified plan, or

- $1,600 in total for awards made under both qualified and nonqualified plans.

Certain prizes and awards given in recognition of charitable, scientific, artistic, or educational achievement are not taxable if the recipient transfers them to a charitable organization.

A prize or award that is not cash or cash equivalent, of nominal value and provided infrequently is excludable from an employee’s wages. Prizes or awards that are given frequently to an employee do not qualify as an excludable de minimis award, even if each award is small in value.

Examples of excludable de minimis awards:

- Nominal gifts for birthdays, holidays

- Holiday turkey and hams

- Flowers, plaques, coffee mugs for special occasions

- Gold watch on retirement.

- Parking for employee of the month if value is less than $315 per month for 2024.

Professional Licenses and Dues

Employer reimbursements to employees for the cost of their professional licenses and professional organization dues may be excludable if they are directly related to the employee’s job.

If you are an employer seeking additional information about a fringe benefit, or an employee wanting additional information related to the taxation of your employer’s fringe benefits, please contact this office for assistance.