Article Highlights:

- Child Tax Credit

- Dependent Care Benefits

- Recovery Rebates

- Employee Retention Credit

Congress has for years used the tax return as a means of providing benefits to taxpayers in need and incentives to stimulate activities in business, as well as addressing environmental issues. So when COVID-19 hit, Congress and many state governments provided tax benefits to help citizens through the pandemic.

Because the COVID pandemic-related benefits have come to an end, your tax refunds may be smaller this year, and substantially smaller for many. The following is a rundown of some areas where decreases in federal tax benefits will affect taxpayers’ 2022 tax refunds.

Child Tax Credit

- 2021 – Taxpayers with children enjoyed an enhanced and refundable tax credit of $3,000 per child under the age of 18 ($3,600 if under age 6) per child in 2021.

- 2022 – The credit has reverted to 2020 levels and the maximum credit for 2022 is $2,000 per qualifying child, of which the maximum refundable amount is $1,500 per child in certain situations. In addition, the credit only applies to children under the age of 17.

Non-refundable tax credits can only be used to offset tax liability and any excess is lost. On the other hand, a refundable credit offsets tax liability and any excess is refundable.

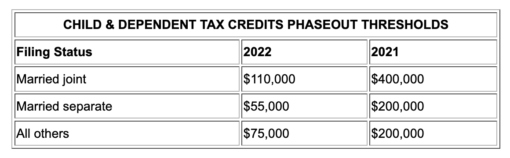

In addition, the child tax credit has always phased out for higher income taxpayers. For 2021 the phaseout thresholds were substantially increased as illustrated in the table. However, that increase was for 2021 only and the thresholds have reverted to 2020 levels for 2022.

Dependent Care Benefits

The tax code provides a tax credit to help working taxpayers that pay care expenses for their children and other qualifying individuals. The credit is a percentage of the dependent care expenses incurred, but those expenses are limited to specific amounts and the taxpayer’s income from working. The credit percentage also declines for higher income taxpayers.

2021 – The credit was fully refundable, and the credit was a flat 50% of the allowable expenses up to $8,000 for one and $16,000 for two or more qualified individuals. Thus the credit could be as much $4,000 for one and $8,000 for two or more qualified individuals.The 50% credit rate began to phase out when the taxpayer’s AGI reached $125,000, but the rate wasn’t reduced below 20%.

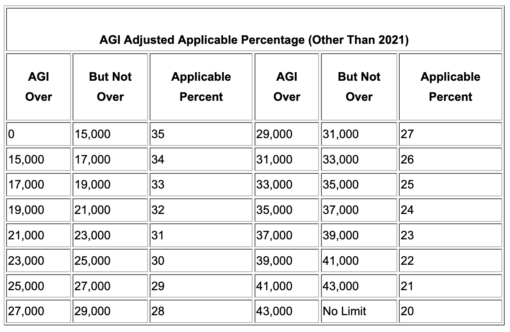

2022 – The credit is not refundable, and the credit rate ranges from a high of 35% to a low of 20% (see table) of the allowable expenses up to $3,000 for one and $6,000 for two or more qualified individuals.

Recovery Rebates

As a means of providing financial assistance to individuals during the COVID pandemic, Congress authorized Recovery Rebate Credits (also referred to as economic impact payments) for the 2020 and 2021 tax years.

- 2021 – The rebates, which generally were issued by the federal government during the year but which may have been claimed on the 2021 tax return, were:

- $1,400 ($2,800 for joint filers)

- $1,400 per dependent

- 2022 – There were no rebates

Employee Retention Credit

As the title implies, this is a credit whose purpose was to help employers retain employees on payroll even though the employer’s business was in decline because of COVID.

- 2021 – The payroll credit was 70%of qualified wages up to $10,000 per employee for any quarter 1/1/21 through 9/30/21 or 12/31/21 for Recovery Start-Ups.

- 2022 – There is no longer a credit for years after 2021.

As you can see there have been some significant reductions of tax benefits that can have a substantial impact on your refund for 2022. Please contact this office if you have questions or would like to adjust your withholding to alter your refund for 2023.